By Jiho Lee, Korean Journal Reporter

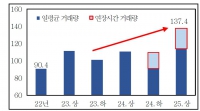

SEOUL — At a briefing held on June 18, the Bank of Korea (BOK) projected that consumer price inflation will decrease to the mid-2% range in the second half of 2024. This forecast comes as the first half of the year saw a 2.9% inflation rate, a slight decrease from the 3.3% recorded in the latter half of the previous year, yet still a notably high level. The overall price level remains elevated due to accumulated inflationary pressures since the pandemic.

However, core inflation has recently fallen to the low 2% range, and key indicators suggest that the overall inflationary trend is stabilizing. These factors indicate a gradual easing of price pressures.

The BOK anticipates that international oil prices and grain prices will continue to stabilize and that inflationary pressures from the demand side will remain subdued. Consequently, the central bank expects the inflation rate for the second half of the year to settle in the mid to upper 2% range. BOK Governor Changyong Lee stated, “Prices are expected to follow a gentle downward trajectory consistent with our May outlook. However, we remain vigilant given the uncertainties posed by geopolitical risks and changing weather conditions.”

The BOK particularly highlighted the potential volatility in agricultural prices due to climate change as a risk factor. Empirical analysis indicates that a 1-degree Celsius increase in average temperature could lead to a 2% rise in agricultural prices and a 0.7% increase in consumer prices in the long term. Additionally, the recent trend of some companies raising prices could further complicate the inflation outlook.

Governor Lee emphasized the need for a coordinated effort between the government’s structural reform initiatives and the BOK’s monetary policy to achieve price stability. He pointed out that the higher inflation rate and cost of living in Korea compared to other major economies are largely due to structural issues. Thus, the government needs to address fundamental weaknesses by diversifying supply chains and modernizing distribution systems. Meanwhile, the BOK must continue to implement monetary policy that considers macroeconomic conditions and financial stability.

“While monetary policy can address inflation, resolving the high price levels requires the government’s structural reform efforts,” said Governor Lee. “We will closely coordinate with the government in managing the inflation target.”

Market analysts view the BOK’s announcement as a comprehensive evaluation of inflation and a call for policy coordination. Experts advise maintaining policy flexibility and active communication with the government to manage inflation effectively amid complex domestic and international conditions.

Ultimately, the key is for the government and the BOK to work together to ensure stable price management. Effective management of market expectations and efforts to strengthen the economy’s resilience in the long term are crucial for achieving genuine price stability.

At this juncture, the BOK’s prudent yet proactive monetary policy approach, the government’s macroeconomic risk management, and close coordination between the two institutions are more important than ever. Proactive measures to address structural weaknesses and ensure effective policy implementation are essential for maintaining economic stability.