- At Seoul National University, Global Experts Envision a More Inclusive Financial Future

By Samuel Chung Technology and Business Reporter Nov. 19, 2024

SEOUL, South Korea — In a crowded auditorium at Seoul National University’s Graduate School of Environmental Studies, Steve Young Kim, Binance’s Asia Pacific Director of Business Development, stood before an audience of academics and industry leaders. His message was clear: “Blockchain technology can be the salvation for the financially excluded.”

This bold declaration set the tone for a groundbreaking seminar titled “ESG Meets Blockchain,” where leaders in both fields gathered to explore how these two transformative forces might reshape the future of sustainable business practices.

The numbers are compelling. Binance’s charitable initiatives have already touched more than 2 million lives across 54 countries, with investments exceeding $23 million in 32 projects. But beyond the figures lies a larger vision of financial inclusion and transparency that blockchain technology promises to deliver.

“ESG is no longer optional in corporate management,” said Na Seok-kwon, director of SK Social Value Research Institute, emphasizing the need for quantifiable metrics in evaluating corporate sustainability efforts. This sentiment echoes growing global pressure for businesses to adopt measurable environmental, social, and governance standards.

The intersection of blockchain and humanitarian efforts was dramatically illustrated by Professor Kim Bu-yeol of Seoul National University, who shared his harrowing experience of facing life-threatening situations while attempting to transfer funds to developing nations. “The current system is broken,” he said, “but blockchain offers a way forward.”

The relationship between blockchain technology and practical applications was a central theme. “Just as Tether has demonstrated utility in transfers, practical applications will naturally drive adoption,” explained Professor Cho Jae-o of Hansung University, highlighting how technological advancement could accelerate mainstream acceptance.

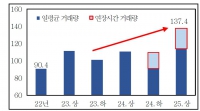

However, amid the optimism, cautionary voices emerged. Professor Kim Kyung-min of Seoul National University warned about the potential for growing wealth disparities due to global liquidity expansion affecting asset prices, including cryptocurrencies. He also emphasized the need for both public and private sectors to remain vigilant about industry changes in the post-Trump era.

In a concrete example of blockchain’s potential for social impact, Ko Jin-seok, co-founder of Block ESG, detailed an ongoing microfinance project in Cambodia. The initiative, a collaboration with Seoul National University’s Graduate School of Environmental Studies, represents a practical application of blockchain technology in sustainable development.

“This is just the beginning,” Mr. Ko said. “The combination of blockchain transparency and ESG principles could revolutionize how we approach social impact and sustainable development.”

The seminar highlighted a crucial moment in the evolution of sustainable finance, where technology meets social responsibility. As businesses worldwide grapple with mounting pressure to demonstrate genuine commitment to ESG principles, blockchain technology offers a promising path forward, potentially transforming how we track, measure, and implement sustainable business practices.

For the global financial community, the message from Seoul was clear: the future of sustainable finance might well lie at the intersection of blockchain innovation and ESG principles. The question now is not if, but when and how this transformation will unfold.