By Samuel Chung, Korean Journal Reporter, ten@tenspace.co.kr

In a recent publication titled “2024 Second Half Economic Outlook,” NH Investment & Securities has identified industrial innovation, particularly centered in the United States, as the key driving force for the global economy. The report highlights how increased investments in advanced technologies such as AI and software are enhancing corporate productivity, thereby creating a virtuous cycle of economic growth.

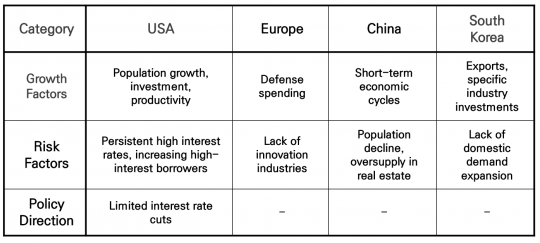

The research division of NH Investment & Securities remarked, “For the first time in nearly 30 years since the early 1990s, the U.S. is experiencing a rise in potential growth rates. This is supported by robust fundamentals such as population growth, increased investments, and improvements in labor productivity.” Notably, the surge in U.S. software investments over the past two years has almost reached levels seen in the early ’90s.

The report also predicts that U.S.-led industrial innovation will not only drive global economic growth but also accelerate decoupling trends between nations. It states, “With advanced technology and supply chain investments concentrated in the U.S., the economic gap with other regions like Europe and China is expected to widen further.”

Europe may sustain itself temporarily due to increased defense spending in response to the Russia-Ukraine war, but its lack of innovative industries is likely to weaken its growth momentum. In China, issues such as a declining population and a sluggish real estate market are reducing potential growth rates, leading to limited economic rebounds.

NH Investment & Securities forecasts that the current expansion phase led by the U.S. could continue until 2025. However, it warns of potential long-term risks, particularly for sectors vulnerable to high interest rates, which could lead to a hard landing eventually.

The report cautions, “In 3-4 years, rising proportions of households with high-interest loans and a surge in maturing corporate bonds could manifest as financial distress. Nevertheless, the overall economic risk remains contained as the proportion of vulnerable groups is currently not high.”

Regarding the Federal Reserve’s monetary policy, the report suggests a slower pace of rate cuts. Despite a slowdown in growth and stabilization of prices, the increase in potential growth rates could result in a higher neutral interest rate level.

Additionally, the Fed is expected to control the pace of its quantitative tightening (QT) to mitigate sharp fluctuations in long-term interest rates. This approach is anticipated to help normalize the yield curve by resolving the inversion between short and long-term rates.

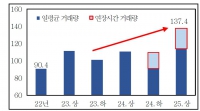

On the Korean economy, the report expresses concerns over weakened growth drivers in both exports and domestic demand. It notes that the export growth rate is slowing, while high-interest rates continue to hamper private consumption and construction investment.

However, it also points out that the financial leverage of households and businesses in Korea is relatively sound compared to other major economies, limiting financial risks. The domestic economy is projected to gradually recover starting from the second half of 2024.